Economics_RS Class 23

A BRIEF OVERVIEW OF THE PREVIOUS CLASS (05:03 PM)

INVESTMENT MODELS (05:07 PM)

- HYBRID ANNUITY MODEL

- It was proposed in 2015 and it is a mix of BOT and EPC. Generally, there are three models in India for awarding national highway projects BOT (Annuity), BOT (Toll ), and EPC (Engineering, production, and construction)

- In BOT Annuity, the developer maintains and constructs the road and gets a fixed payment from the government. This model needs frequent government payments that are guaranteed though deferred sometimes. Since the annuity contracts are long-term (10-20 years), this model may not be attractive in all places.

- In the case of BOT Toll, the traffic or commercial risk is on the concessionaire and the investment is sustained by the Toll revenues. The toll is not feasible in rural and semi-urban areas further, since the collection of toll depends upon traffic, the developer faces traffic risk in this model.

- In the case of EPC, the developer faces construction risk. Under the new model (HAM), the government provides Up-front 40% of the project cost to start the work and the remaining 60% would be financed by the private player. NHAI will collect tolls and refund the private player in installments. This implies that the Toll collection risk is handled by NHAI.

-

- Benefits

- 1) Compared to BOT Annuity, it would ease the cash flow pressure on the government

- 2) Compared to BOT Toll, the traffic risk is not associated with the concessionaire

- 3) Operations and maintenance are handled by the private player thereby increasing the efficiency of the project

SWISS CHALLENGE (05: 45 PM)

- In this method, a private player can submit a proposal to the government for the development of an infrastructure project with an exclusive IPR

- The government can buy the IP Rights from the original proponent and call for competitive bidding to award the project.

- The government may also allow other players with similar capabilities to submit their proposals. If any proposal is better than the original proposal, the original proponent is asked to modify the proposal. If he fails, the project is awarded to the best bidder

- Many states in India are using this method for awarding roads and housing projects. The draft PPP rules 2011 allows the use of Swiss challenge only in exceptional circumstances i.e. For projects in rural areas or for BPL projects

- Advantages

- 1) It encourages private players to bring innovation, technology, and uniqueness to the development of the project

- 2) It will enhance cost efficiency, reduce red tape, and shortens the project timeline.

- Problems/ challenges

- The CVC has observed that there is a lack of transparency and a lack of fair and equal treatment of potential bidders in the Swiss challenge method.

- The planning commission has advised the state government to adopt the Swiss challenge method as an exception rather than a rule

- in the recent past, Vijay Kelkar's committee on revisiting and revitalizing the PPP infrastructure model has discouraged the government from following the Swiss challenge methods.

- Without a strong regulatory framework, the method fosters crony capitalism and is also conducive to discretionary favours.

POSITIVES OF PPP (06:10 PM)

- Access to private sector finance.

- Potentially increased transparency.

- Efficiency advantages by using private sector skills and transferring risk to the private sector.

- Access to advanced technology and availability of additional resources.

- Enlargement of focus from only creating an asset to delivery of service including maintenance of infrastructure assets during its operating lifetime.

LIMITATION OF PPP MODELS (06:16 PM)

- Not all projects are feasible due to political reasons along with commercial viability.

- The success of PPP depends upon regulatory efficiency.

- The private sector may not be interested due to the perceived high risk, lack of an easy exit mechanism, etc.

- Issues of staling of projects.

- Due to Increasing conflict, most of the PPPs are ending up in court.

- Regulatory cholesterol, i.e. too much regulation.

- Increased market risk in the recent past.

- Due to a lack of transparency and information asymmetry, implementing innovative PPP models like the Swiss challenge is difficult.

- PPPs have increased NPAs in the banking system.

- PPPs can lead to increased costs of essential services.

VIJAY KELKAR COMMITTEE RECOMMENDATIONS (06:21 PM)

- PPP contracts focus more on fiscal benefits. The Committee recommended that the focus should instead be on service delivery for citizens. Further, fiscal reporting practices and performance monitoring of PPPs should be improved.

- The Committee noted that inefficient and inequitable allocation of risk can be a major factor leading to the failure of PPPs. PPP contracts should ensure optimal risk allocation across all stakeholders by ensuring that it is allocated to the entity that is best suited to manage the risk.

- A national-level institution should be set up to support institutional capacity-building activities and encourage private investments with regard to PPPs.

- An Infrastructure PPP Adjudication Tribunal should also be constituted.

- A quick, efficient, and enforceable dispute resolution mechanism must be developed for PPP projects.

- An Infrastructure PPP Project Review Committee may be set up to evaluate PPP projects.

- NOTE- Refer to the PPT given in the class handout

NATIONAL INCOME (06:30 PM)

- Framework

- Different types of economic systems- Market economy, Command economy, Mixed economy

- 4 sectors of the economy- Households, Private, Government, External sector

- Circular flow of income

- Different types of goods- Intermediate and Final goods

- Concept of GDP, the concept of territory

- Gross v/s Net

- FC v/s MP (GDP at FC v/s GDP at MP)

- Domestic V/s National

- Concept of NFIA

- Different methods of GDP calculation- Expenditure, Income, and production method

- Concept of transfer payment

- Concept of the base effect, Base year

- Nominal GDP and Real GDP

- Concept of GVA at basic prices

- National income- 8 aggregates

- National income v/s personal income

ECONOMIC GROWTH (06:40 PM)

- Economic growth is measured through GDP

-

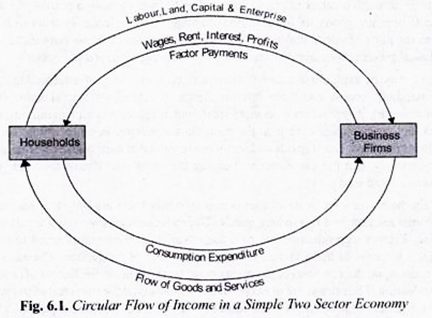

- It is a two-sector economy involving firms and households

- Factor services, land, labour, capital, and entrepreneurs are provided by the household.

- In return, the firm makes a factor payment in the form of rent, wages, interest, and profits.

- Such payments are nothing but factor income for the household as there are no transfer payments involved.

- These incomes are called Productive income.

- Non-productive income- Free pension to the household.

- Households use this income on expenditures like goods and services, to be bought from the firm.

- Assumptions

- No government interference

- No trade or export

- No bank involvement

- National income

- NI= Income of the residents of the country (From within the country + Receiving income from the rest of the world)

- National income should be generated through Productive income

- Pension is non-productive income and it will not be part of national income. It is a part of the transfer payment

- [* Transfer payments are all those unilateral payments corresponding to which there is no exchange of goods and services in the economy. For example, gifts, donations, old age or disability pensions, unemployment compensation, Remittances, etc.]

- [** However, pension to retired employees is not a transfer payment as the services were already rendered by them before retirement.]

- Note: Transfer payments are not included in the national income. Transfer payments are included in the personal income.

DIFFERENT TYPES OF ECONOMIC SYSTEMS (07:25 PM)

- Factors that affect demand

- a) Price

- b) Income

- c) Substitutes

- d) Preferences

- e) Complementary items

- Market Economy

- A market economy is one in which individuals and private firms make the major decisions about production and consumption.

- Consumption is determined by individual decisions on how to spend wages and property income, generated through labor and property ownership.

- In the extreme case of a market economy, government regulation is almost zero, and economic decisions are taken by private players (laissez-faire economy).

- Command economy

- In a command, the economy government makes all important decisions about production and distribution.

- The government owns most of the means of production (land and capital).

- The government also decides how the output of the society is to be distributed. Today's contemporary societies are mixed economies with elements of market and command.

- In the present world, most of the decisions in developed and developing economies are made in the marketplace, but the government also plays an important role in overseeing the functioning of the market.

FOUR SECTORS OF ECONOMY (07:35 PM)

- Private sector

- All the enterprises owned by private individuals or groups of individuals belong to the private sector.

- The private sector consists of companies, and firms, which are not owned by the government.

- Household sector

- A group of persons who normally live together and take food from a common kitchen constitutes a household. The household consists of people who work in firms as workers and earn wages. Households can also set up businesses and earn profit therefore the population belongs to the household sector.

- Government sector:

- It includes the public administration, police, defence, etc. Apart from imposing taxes and spending money on various services like healthcare, the government also undertakes production activities. Examples- NTPC, BHEL, Coal India Ltd., etc. Public sector undertakings also belong to the government sector.

- External sector

- It includes the rest of the world i.e. Goods and services flowing into the country or outflow.

IMPORTANT CONCEPTS UNDER NATIONAL INCOME (07:42 PM)

- A. Domestic/ Economic territory

- It refers to the geographical territory administered by the Indian government within which persons, goods, and capital can circulate freely.

- Foreign embassies located in India are not part of domestic/economic territories, whereas Indian embassies located abroad are a part of domestic/economic territories.

- Domestic/economic territories also consist of

- 1. Military establishments, consulates & embassies, etc. located in a foreign country

- 2. Fishing vessels, ships, aircraft, etc. also fall under the domestic territory.

- For example, the revenues and profits of Air India are counted within India's GDP

- B. Types of Goods

- Intermediate goods

- These are semi-finished goods that can not be used as it is and need to go through a further production process to be converted into final goods

- For example, steel sheets or plastics used for producing cars, etc.

- Note- Intermediate goods are not part of GDP calculation as it leads to "Double counting".

- Final goods

- These goods do not undergo any further transformation in the production process.

- Final goods can be divided into two types

- a) Consumption Goods

- Goods that are consumed by the ultimate consumers or meet the immediate need of the consumer are called consumption goods

- Consumption goods can be categorized as

- i) Non- Durable consumption goods:

- The consumption goods that are consumed immediately. For example, food, clothing fuel, etc.

- ii) Durable consumption Goods

- These goods do not get exhausted immediately but last over a period of time (consumer durables). For example furniture, Television.

- iii) Services

- Services are intangible and are a kind of consumption good as it is consumed immediately

- For example education, health, etc

- b) Capital goods

- Capital goods have to possess the following three characteristics

- i) It is a produced durable output of a man-made process

- ii) It again acts as an input for the further production process

- iii) While acting as an input it does not get transformed or consumed

- In a simple sense, capital goods are those goods that are used in producing other goods

The Topic for the next class:- GDP at factor cost, Market price, Transfer payments, GDP calculation, etc.